To start off on the right foot

The music scene in France boasts diversity and strong vitality, with nearly a third of French people playing at least one musical instrument, averaging 1.7 instruments per individual. While musical practice attracts enthusiasts from all social classes, the majority of musicians live with a median income higher than the national average.

The Study

This study was conducted entirely online between October 7th and November 2nd, 2022 by Xerfi Spécific on behalf of the CSFI (Chambre Syndicale de la Facturation Instrumentale). It covers the entire musical instrument market in France and is based on 9 categories of instruments and accessories, as follows :

Respondent Typology

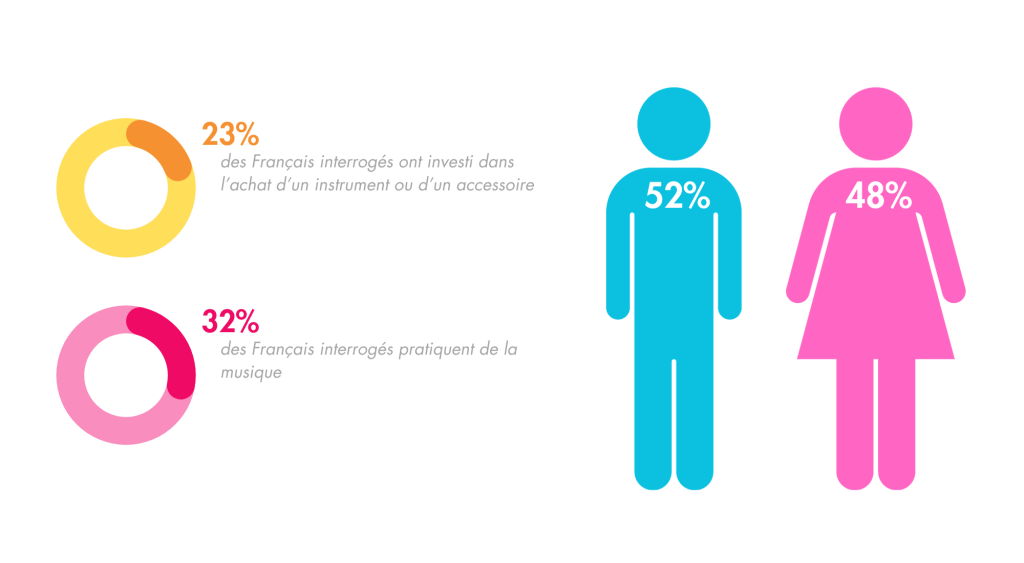

The study data were collected from 8,812 French individuals over the age of 18, among whom 32% (2,820 individuals) practice music and 23% have recently invested in purchasing an instrument or accessory.

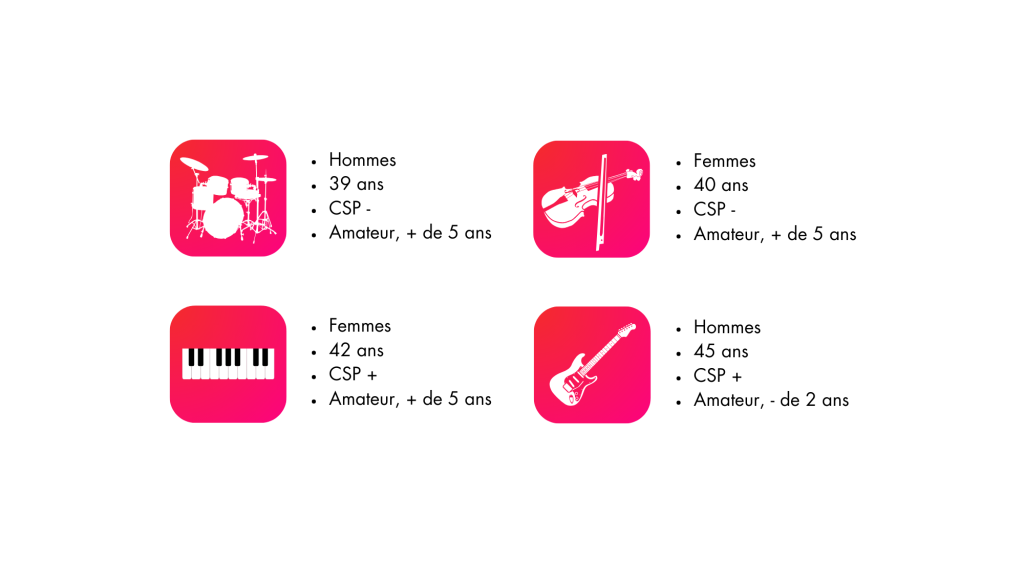

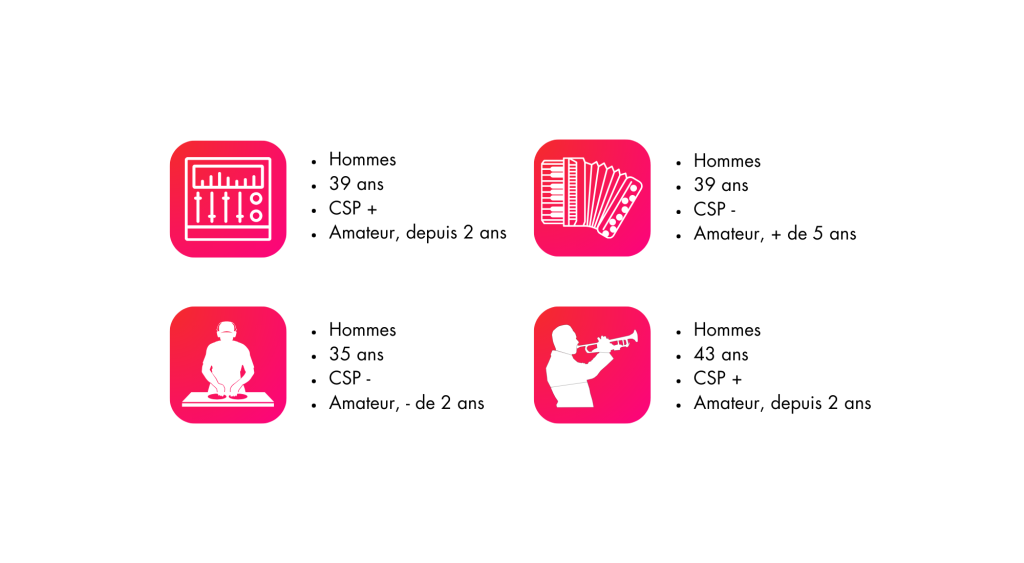

It emerges that over 70% of respondents play at least the piano and/or guitar. The distribution among musicians is well-balanced, with 52% male and 48% female, making music a shared passion. The majority of the most active music enthusiasts fall within the 35-49 age group, representing 29% of the musician population.

In summary :

The socio-professional distribution also reflects diversity, creating an inclusive musical environment as shown below :

The time devoted to musical practice being significant, the study demonstrates that it is employees who dominate the market of musical practice compared to senior executives who have less available time to play.

It is interesting to note that musician families are strongly represented and that they pass on their love for music to their children. Indeed, among the 54% of families with at least one child, 92% attest to having passed on the passion for music to one of their children.

Vidéo introductive

THE MUSICAL INSTRUMENT MARKET IN FRANCE

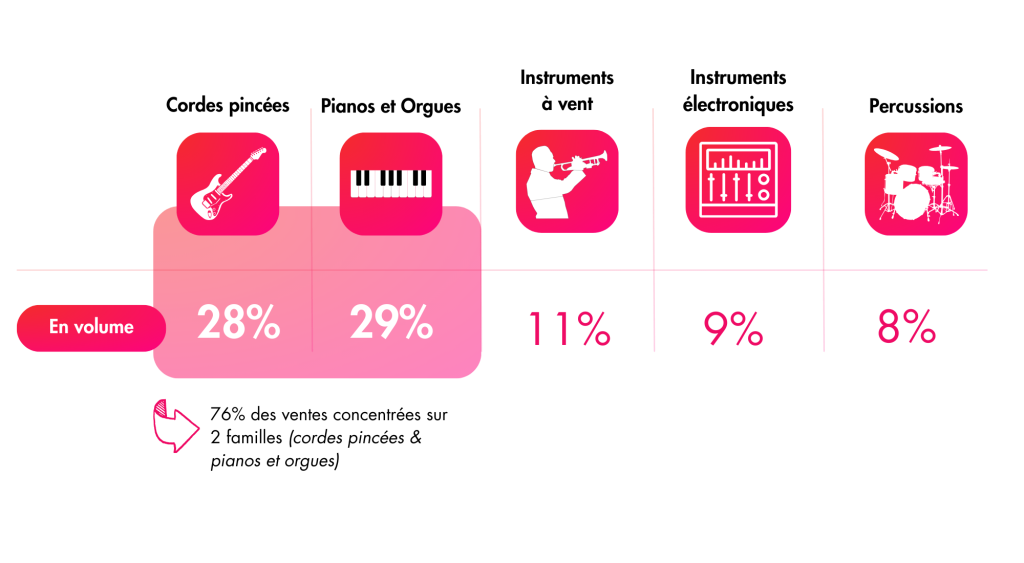

Music is a transgenerational art and can be practiced both in groups and solo. The piano and the guitar stand as the cornerstones of the musical market, bringing together over 70% of the surveyed musicians and occupying 76% of the market for new instruments.

Regarding purchases, it is noted that 71% of the surveyed musicians have acquired at least one instrument in the past 5 years or an accessory in the past 2 years. In 2021, 1,680,000 instruments were acquired or rented, of which 1,008,000 were purchased new, driven by the desire for a particular instrument. In terms of purchasing channels, 32% of transactions were made in general stores, such as supermarkets.

Purchase preferences tend towards the families of stringed instruments and pianos and organs. Indeed, pianos and guitars represent 57% of sales in volume, emphasizing their strong position in the market.

In terms of figures, the market for new musical instruments reached a value of €534 million in 2021, with an average basket size of €529.36.

The Pass Culture, a niche not to be overlooked. Indeed, 36% of the surveyed music enthusiasts stated that they had used the Pass Culture to acquire a musical instrument. It is worth noting that music is the second highest expenditure category on the platform after books. So, consider listing the eligible instruments from your Rockstation corner on the platform.

Purchase Motivation

Understanding the purchasing motivations of musicians is beneficial for businesses. The study demonstrates here that product availability is the primary purchase motivation, accounting for 30% of purchase decisions.

However, cost also remains a crucial factor, with 21% of respondents highlighting its importance.

The health crisis has also influenced purchasing behaviors, with 24% of the individuals surveyed stating that they have been influenced by the pandemic. The health crisis has prompted nearly a quarter of musicians to acquire a musical instrument.

EVOLUTION OF CONSUMER BEHAVIORS

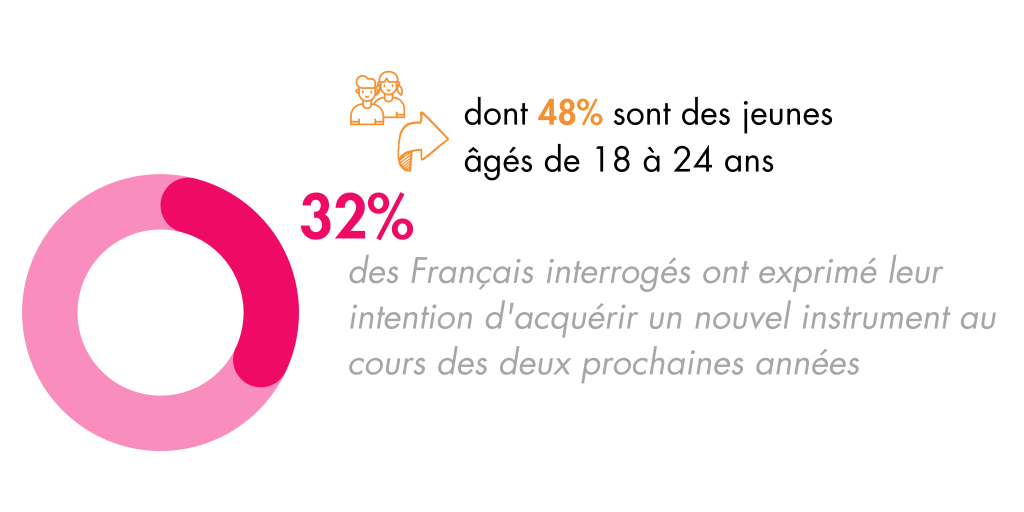

Among the respondents, 37% have started their musical practice in the last five years, of which 45% belong to the socio-professional category -. Moreover, no less than 32% of the individuals surveyed have expressed their intention to acquire a new instrument in the next two years, of which 48% are young people aged 18 to 24, thus highlighting the emergence of the new generation of musicians.

Gaming habits also remain a topic of interest. 26% of respondents claim to play as much as they did five years ago.

INTERVIEWS & REPAIRS

Regular maintenance of a musical instrument is important to ensure its proper functioning and prolong its lifespan. According to the study, 31% of surveyed musicians acknowledge having used maintenance or repair services for their instrument, with a majority being young people aged 18 to 24, representing 44% of them.

THE ACCESSORIES MARKET

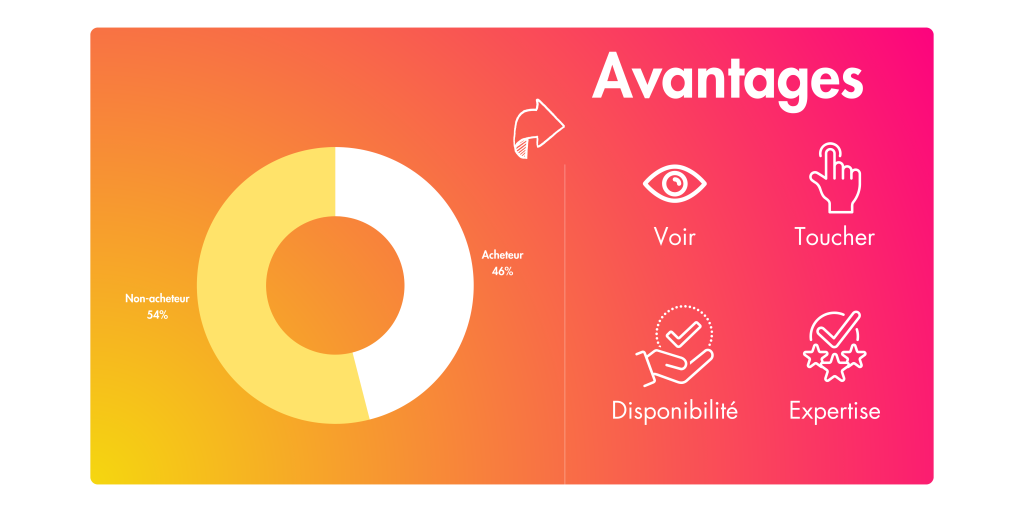

For all musicians, the importance of choosing the right equipment cannot be underestimated. According to the study, 46% of the respondents have made at least one purchase of musical accessories in the last two years.

It is interesting to note that stringed instrument musicians, especially guitarists, spend the most on accessories, given the rapid wear and tear of their equipment and the intensity of practice. However, it is DJs who are the biggest spenders, allocating a budget of 287.05 euros, while stringed instrument players are the least spenders with an average budget of 136.71 euros.

Regarding purchasing methods, most technical accessories are acquired in-store, taking advantage of the tactile experience and advice from salespeople. Less technical products, such as maintenance products and cases, are more commonly purchased online with home delivery.

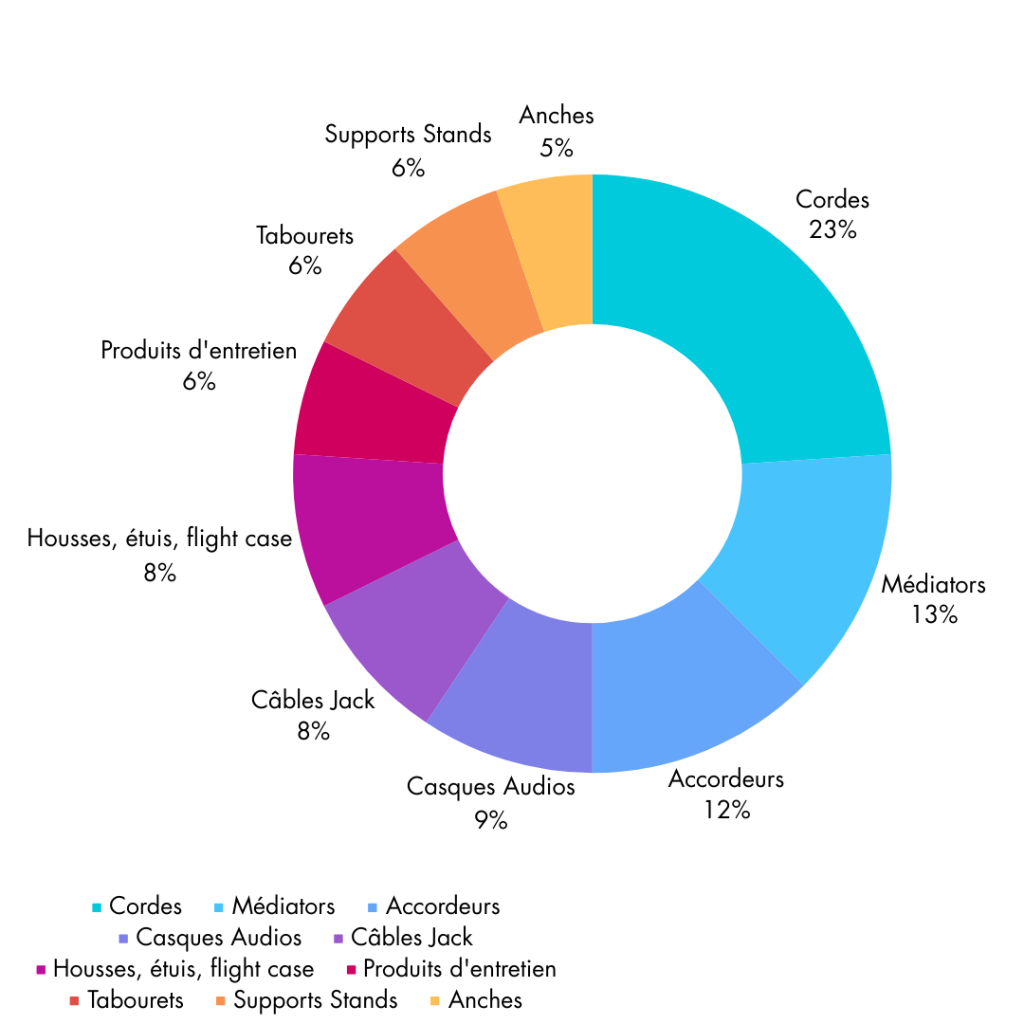

The top three most purchased accessories are exclusively for guitarists, with strings, picks, and tuners taking the top spots.

TOP 10 of the most frequently purchased accessories :

To go further :